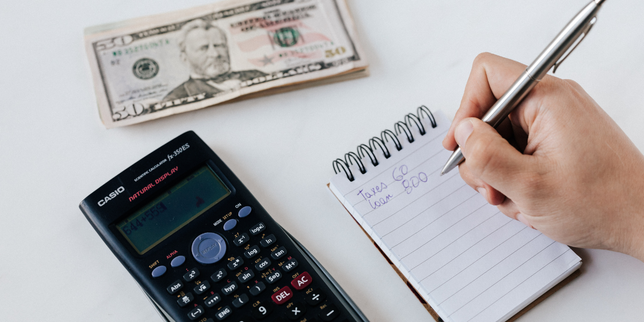

No matter how successful a business may be, one key factor that remains consistent in its success is financial literacy. It’s the cornerstone of any industry and the lack of it can spell disaster quickly. Financial planning is among the most important investments you can make for your business’s future. After all, without a proper understanding of money management, how do you budget or know when to splurge?

From writing sketchy invoices to crafting cash flow statements; from assessing ROI on marketing campaigns to knowing how much capital to set aside for taxes—it’s easy to see why having an experienced financial planner by your side would benefit everyone small business owners looking Acheter cialis en ligne france for profits to larger corporations positioning themselves global marketplaces.

In this blog post, we will explore the importance of having professional assistance with your finances as well as discuss some tips and tricks that help keep everything organized and running smoothly in order to stay ahead of the competition!

Analyze your current financial situation and set goals for the future

The first crucial step in financial planning is to analyze your current financial situation. This involves understanding and documenting your income sources, expenses, liabilities, and assets. It’s essential to be honest and accurate during this process as it lays the groundwork for setting realistic financial goals. Once you have a clear picture of your present financial state, it’s time to set both short-term and long-term goals. Remember, these goals should be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound.

For instance, a short-term goal could be reducing operational expenses by 10% within the next six months, while a long-term goal might be increasing net profit by 30% over the next three years. These goals serve as a roadmap to guide your financial decisions and strategies, thereby ensuring your business remains sustainable and profitable.

Develop a budget to monitor expenses and plan for growth

Developing a budget is a key step in financial planning as it allows you to control your money flow and plan for future growth. A well-crafted budget outlines where your money goes identifies potential areas of overspending, and aligns your expenditures with your business goals.

It’s important to include all your income sources and expenses, both fixed and variable, to create a comprehensive budget. Regularly review and adjust your budget as necessary to reflect changes in your income or expenses.

Remember, a budget is not a static document but a dynamic tool that should evolve as your business grows and changes. Using a budget, you can anticipate future expenses, prevent unnecessary outlays, and make informed decisions to facilitate business growth.

Research ways to reduce costs and increase profits

Every business’s ultimate goal is to maximize profits while minimizing costs. With the ever-changing market and economy, finding ways to reduce costs and increase profits can be challenging yet imperative.

A common approach is to assess current expenses to identify areas where cuts can be made. However, it’s important to approach cost-cutting strategically and avoid cuts that could hurt your business in the long run. Another effective way to increase profits is to look for new revenue streams.

You can research and invest in new products or services that align with your existing offerings and target the needs of your customers. No matter the approach you choose, the key to success is careful planning, analysis, and execution.

Take out a loan or credit

Securing a loan or credit can be an effective strategy in financial planning, providing the means to invest in opportunities for growth while managing cash-flow challenges. You can take out a line of credit to help cover short-term expenses or unexpected costs, while a business loan can provide the necessary capital for larger investments such as expanding into new markets or purchasing equipment.

Consider consulting with a financial planner to determine if taking on debt is a viable option for your business and develop a repayment plan that works for your budget. Before obtaining a loan, it’s crucial to thoroughly evaluate your business’s financial health and its ability to repay the loan. Consider the interest rates, repayment terms, and the potential impact on your credit score.

It’s also essential to determine how the funds from the loan will be used to generate profit or improve business operations. Remember, a loan is not free money, but a financial obligation that needs to be paid back promptly to avoid further debt and potential damage to your business’s financial reputation.

Establish separate bank accounts for personal and business expenses

Separating your personal and business finances is a critical aspect of financial management and planning. Having distinct bank accounts for personal and business use simplifies bookkeeping, aids in identifying business expenses for tax deductions, and provides a clear overview of your business’s financial health.

With a separate business account, you are less likely to mix up personal and business expenses, which can lead to overspending and inaccurate financial records. A separate account also enhances your professional image, as payments to vendors and receipts from clients are transacted through an account in your business’ name.

Furthermore, if your business is structured as an LLC or corporation, keeping personal and business finances separate is legally required to maintain your liability protection.

Consider investing

By investing, you can create additional sources of income that have the potential to grow over time. While it’s important to do your research and understand the risks associated with investing, the potential rewards can be significant. Plus, with the rise of online investment platforms and resources, it’s easier than ever for beginners to get started. Imagine the peace of mind that comes with having multiple streams of income and the flexibility to pursue the things you truly enjoy. It may be time to take the leap and start exploring investing options that could change your financial future.

Create an emergency fund

Creating an emergency fund is an essential step in financial planning, one that provides a safety net for your business during unforeseen circumstances. This fund provides financial stability, enabling operations to continue during unexpected events such as economic downturns, unexpected expenses, or sudden losses in revenue.

An emergency fund should ideally contain enough to cover at least three to six months’ worth of business expenses and should be kept in a readily accessible account to ensure funds can be quickly deployed when needed. In the volatile world of business, an emergency fund is not just a nice to have but a necessity for long-term survival and success.

Takeaway

Financial planning is the lifeblood of any successful business, regardless of size or industry. It involves understanding your current financial situation, setting clear and realistic goals for future growth, and creating a comprehensive budget to monitor expenses. Strategies like cost-cutting, exploring new revenue streams, taking out loans or credits, and establishing separate bank accounts for business and personal use are key elements in this process.

Furthermore, investing in diverse areas and creating an emergency fund can safeguard your business against unforeseen circumstances and ensure long-term financial stability. Remember, the journey toward financial literacy is ongoing, and having an experienced financial planner by your side can provide invaluable guidance along the way.

Amit is a lifelong learner and advocate for personal growth, fueled by 15+ years in HR across various functions. His journey includes a dual Master's degree: an MBA specializing in HR and Information Technology, and another Masters dedicated to HR Management & career development. This blend of knowledge allows him to translate personal development strategies into actionable steps. Whether you're seeking career advancement or simply becoming your best self, Amit is here to share insights, tips, and inspiration to help you unlock your full potential.