Introducing financial literacy is essential in today’s society. With the increasing cost of living, it’s important to understand and master sound money management techniques.

Financial literacy helps people make informed decisions about spending, saving, investing, and more. In this blog post, we will discuss why it is so important, how to acquire said literacy, and what steps you can take to be financially responsible.

By learning about finances and developing a financial plan for yourself, you will gain the confidence to make informed decisions that will lead to a healthy financial future. So let’s dive in and get started!

Utilize Financial Apps For Loans

Financial apps are a great way to quickly access loans and other financial services. With just a few clicks, you can apply for loan options from the comfort of your own home. There are numerous types of loans available through these apps, including personal loans, payday advances, auto financing, student loans, and more.

When it comes to a credit application, financial apps make it easy to review loan terms and interest rates. With the right loan and payment plan, you can borrow money for nearly any purpose and have it available in your account quickly.

Financial apps are a great way to get fast access to cash when you need it most.

Budgeting Is Crucial

Creating and sticking to a budget is one of the most important aspects of financial stability. Budgeting helps you manage your money by setting limits on how much you can spend in certain areas, such as housing, entertainment, food, clothing, and more.

When you create a budget, it allows you to track your spending so that you can be sure that you are staying within your means.

It’s essential to be realistic and willing to make adjustments as needed. It can also be helpful to put yourself on a monthly allowance so that you know exactly how much money is available for spending each month.

Budgeting is one of the most crucial aspects of financial literacy, and it can help you make wise decisions about how to use your money.

Saving for Emergencies

Saving for emergencies is another essential aspect of financial literacy. Unexpected expenses can happen at any time, so it’s important to be prepared by setting aside money in an emergency fund. This fund should be easily accessible and contain enough money to cover at least three to six months of living expenses.

By setting aside a portion of your income each month, you will have the peace of mind that comes with knowing that you are prepared for whatever life throws your way. Being fiscally responsible can help you build an emergency fund, so you don’t have to worry about unexpected expenses.

Setting Expectations

One of the most important aspects of commanding your funds is setting expectations about how you handle your finances. This means understanding what you can realistically afford and budgeting accordingly. It also means understanding that some brands might be out of reach or too expensive for your current situation.

Knowing what’s attainable and what isn’t, and then setting a reasonable plan for achieving your financial goals, is a crucial part of being financially literate. By setting expectations that are realistic and achievable, you’ll be able to stay on track with your finances and reach your ultimate financial objectives.

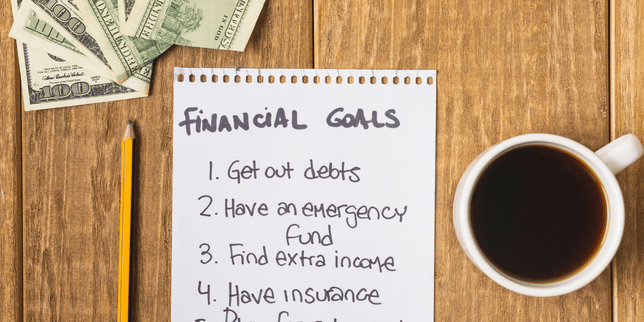

Make A Roadmap Of Goals

Creating a roadmap of goals is an important step in achieving financial freedom. Goals provide direction and purpose when it comes to managing finances, helping you plan out where you want to go and how you’re going to get there.

When developing your roadmap, it is best to begin with short-term goals such as budgeting effectively, reducing debt, and setting aside money for emergencies.

Once these goals are accomplished, you can work on creating long-term goals such as investing, saving for retirement, or building a financial portfolio.

Having clear, attainable goals will keep you motivated and help you stay focused on your path to financial literacy. It’s important to remember that this journey is an ongoing process, so it’s a good idea to review and adjust your roadmap of goals as needed.

With hard work and dedication to achieving these goals, you can become financially literate in no time.

Pay Your Bills On Time

Financial literacy is not just about having knowledge of financial concepts. It’s also about putting that knowledge into practice to ensure sound financial health.

One of the most important practices for any individual should be to pay their bills on time. Paying bills on time helps avoid late fees, maintain a good credit score, and can even help establish a budget. All of these things can lead to a more financially stable future.

It’s important to note that this is not just about learning how to save money. It’s also about understanding how to use credit responsibly and make sound investment choices.

Anyone can benefit from becoming more financially literate. By paying bills on time, individuals can set themselves up for a more secure financial future.

Check And Maintain Good Credit Scores

Good credit scores are essential for nearly any investment, as they provide a snapshot of a person’s fiscal responsibility. It is important to stay on top of your credit score and ensure that all accounts are up to date.

Paying bills on time, using credit cards responsibly, and avoiding unnecessary debt can all help maintain a good credit score.

A good credit score can save you money in the long run by helping you secure lower interest rates on loans and credit cards. It can also help you qualify for better terms on leases and insurance policies.

Financial literacy is about more than just knowing how to budget – it’s about understanding all aspects of your finances, including your credit score.

Takeaway

In conclusion, all of these are important skills to have in order to be successful financially. It involves setting expectations, creating a roadmap of goals, paying bills on time, and checking and maintaining good credit scores.

By being responsible with your finances and understanding the basics of financial literacy, you can set yourself up for long-term financial success.